Table Of Content

For example, the Chase Sapphire Preferred® Card is a Visa card for people with good credit that offers points per $1 on purchases. Chase’s signature collection of debit card designs is a testament to their commitment to providing customers with options that are both visually stunning and versatile. This collection features designs that cater to a broad range of interests, ensuring that there is something for everyone. Express your unique personality through the stylish Chase debit card designs.

How to Become a Disney Travel Agent

Reading reviews will allow you to determine if there is a pattern of behavior that demonstrates poor customer experience. While no company is going to be perfect, seeing how they resolve customer complaints and issues will be useful in making your determination to do business with them. However, a service that is transparent about what it covers and what it does not is key. Make sure you read all the information to understand what is covered, how the service is provided, and the limitations of the service, if any. Read the terms of any insurance plans carefully and ensure you understand what losses are actually covered and what your duty of care or other obligations are to seek reimbursement for losses. One negative of IDShield is that it tends to get lower marks for its interface; if that deters you from using the security features, then whatever you save in monthly fees is nullified.

banking basicsManaging money as a digital nomad

After enrolling in wire transfers, you'll see your daily transfer limit, before being prompted to add a recipient. Julie Stephen Sherrier is a personal finance writer and editor based in Austin, TX. She is the former senior managing editor for LendingTree, responsible for all credit card and credit health content. Before joining LendingTree, Julie spent more than a decade as the managing editor and then editorial director at Bankrate and CreditCards.com.

banking basicsWhat is mobile banking?

If your identity is stolen, you can lose money and time and may find it really difficult to obtain loans, credit cards, and other financial products. PrivacyGuard provides many services that are harder to replicate without paying, like dark web scanning and public records monitoring at lower prices than its competitors. PrivacyGuard also provides bank account and credit card monitoring, which are surprisingly scarce features among identity protection services.

Chase Sapphire Preferred Credit Card Review 2024 – Forbes Advisor - Forbes

Chase Sapphire Preferred Credit Card Review 2024 – Forbes Advisor.

Posted: Mon, 22 Apr 2024 20:15:00 GMT [source]

It is crucial to proactively obtain identity theft protection before any issues arise. When shopping for identity protection, you should think about how much of a risk identity theft poses. Obviously, everyone can be targeted, but some people are at higher risk. Additionally, people who were victims of identity theft are more likely to be targeted than those who have never had their identities stolen. Those practices, combined with well-rounded identity theft protection, will significantly reduce the risk of having your personal information compromised. Protecting your identity and other sensitive personal information is like protecting your home against fire.

Everything you should know about Bank of America’s Preferred Rewards program - The Points Guy

Everything you should know about Bank of America’s Preferred Rewards program.

Posted: Tue, 19 Dec 2023 08:00:00 GMT [source]

Available Chase Credit Card Designs

Our suite of security features can help you protect your info, money and give you peace of mind. See how we're dedicated to helping protect you, your accounts and your loved ones from financial abuse. Also, learn about the common tricks scammers are using to help you stay one step ahead of them. If you see unauthorized charges or believe your account was compromised contact us right away to report fraud. Get more from a personalized relationship offering no everyday banking fees, priority service from a dedicated team and special perks and benefits.

BitPay essentially acts as a gateway service to convert your crypto into fiat currency and pay for your bills directly. If you choose to purchase crypto with your credit card, there are multiple fees and charges that may be added to your purchase. Rather than estimating the cost, take the time to calculate the entire cost—cash advance fees and interest, plus crypto exchange fees—before proceeding. But there are only a few credit card issuers and crypto exchanges that offer this option. There are also third-party gateways that let you purchase crypto with a credit card as well, but with even higher fees than a crypto exchange.

This shift marked the beginning of a new era in debit card design, where the possibilities were endless. These opportunities are often thanks to a brand partnership between your bank and particular airlines, hotels or other companies. It’s a hassle-free way to get your hands on a unique and eye-catching debit card design that reflects your personal style. Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor.

When you make a debit card purchase, some merchants may allow for cash withdrawals as part of the transaction. Your account will be debited for the total amount of your purchase plus the cash withdrawal. So, walk away from the merchant with the item you bought, as well as cash without going to an ATM. Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit.

Simply navigate to the appropriate section and follow the instructions provided. Deposit and credit card products provided by JPMorgan Chase Bank, N.A. Member FDIC© 2024 JPMorgan Chase & Co. "Chase Private Client" is the brand name for a banking and investment product and service offering, requiring a Chase Private Client Checking℠ account. If you’re looking for sports teams you can’t get that with Chase, and other issuers have dropped sports-related card options like Bank of America with MLB and Barclays with the NFL.

This credit card comes with one of the ten available themes you can choose from. It works like any other credit card and will be linked to your Chase bank account. Disney Visa premium is a credit card issued by Chase bank in collaboration with Disney Rewards.

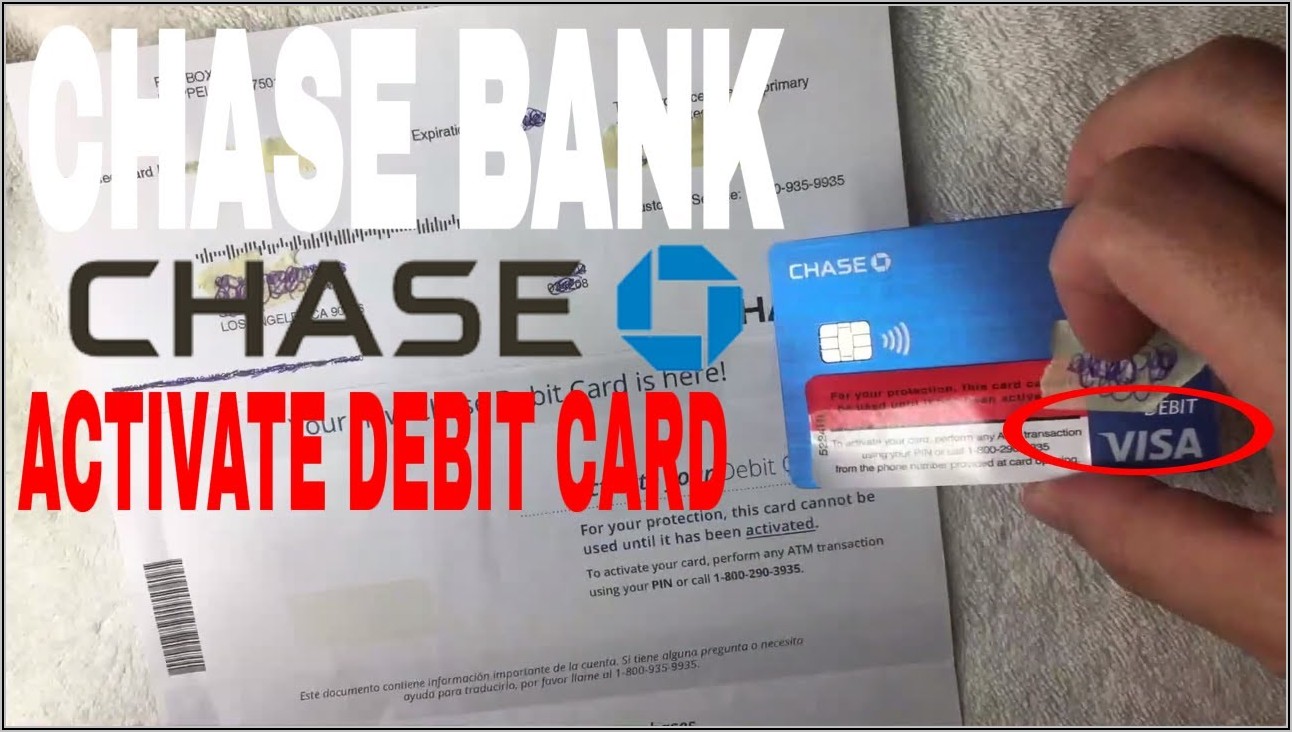

Carry a masterpiece in your pocket and let your card be a conversation starter. Another option you may have through your bank is to activate your debit card digitally. Using an updated version will help protect your accounts and provide a better experience. Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo.

Yes, you can put a design on a debit card by calling the phone number on the back of the card or ordering online. You also won’t be able to customize most of the co-branded credit cards like the Chase Southwest, Marriott, IHG, United, and other similar cards. Chase typically charges a balance transfer fee from 3% to 5% with a $5 minimum. Before you complete a balance transfer, be sure the interest you save will outweigh the fee. In addition to my response above, also read consumer reviews and look at third-party accreditation sites such as the Better Business Bureau.

No comments:

Post a Comment